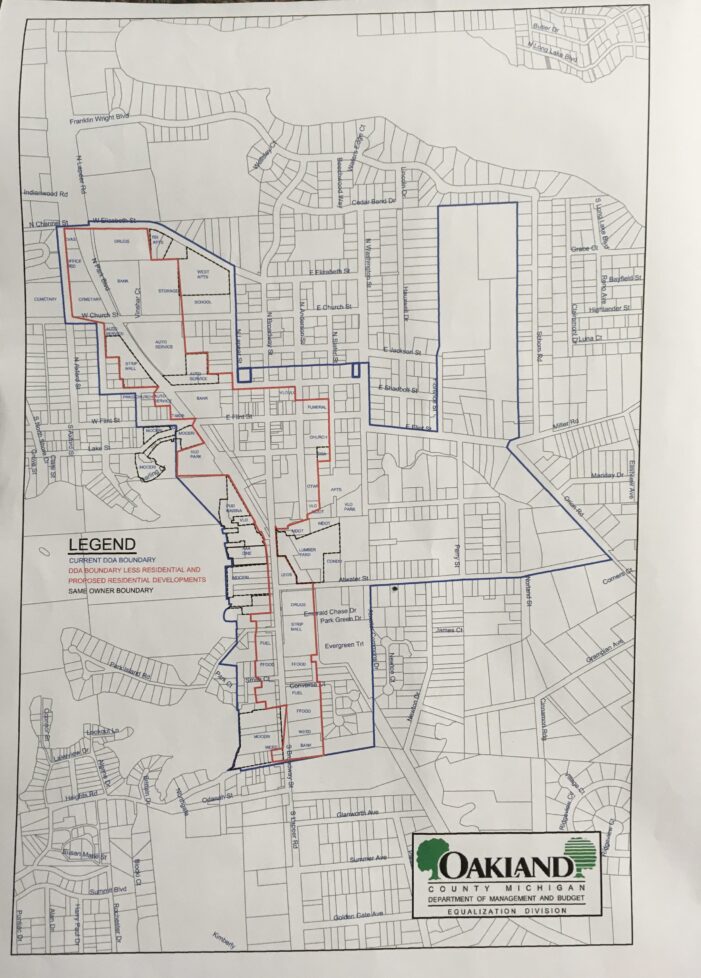

The map above shows the current Lake Orion Downtown Development Authority district boundary in blue. Many of the areas on the east (right) side of the district are residential and some on the Lake Orion Village Council are considering a proposal to remove the residential properties from the district.

The area in red shows one potential DDA boundary, which would capture taxes from the businesses on the M-24 corridor and downtown Lake Orion business district while excluding the residential areas. Taxes from those residential areas would go back to the Village of Lake Orion and the other entities, such as Oakland County and Orion Township, that have millages in the area.

The proposed boundary eliminates from the DDA District future developments like the Ehman Center redevelopment and any development at the Lake Orion Lumber Yard site.

Map provided by Lake Orion Village, through Oakland County Department of Management and Budget, Equalization Division.

By Jim Newell

Review Editor

Village Councilmember Michael Lamb gave a presentation on the possibility of shrinking the Lake Orion Downtown Development Authority’s Tax Increment Financing (TIF) District, saying the village should remove the residential properties from the DDA’s tax captures.

Lamb gave the presentation during the council meeting on Monday, his second presentation in as many meetings.

He had previously given a presentation on DDA’s tax capture and asked several questions about the money the DDA is collecting at the council’s March 14 meeting.

“Why is 50 percent of the DDA downtown district residential properties?” Lamb asked. “Review of the zoning maps and DDA maps of the 24 communities in Oakland County that have DDAs show that they do not include nor capture taxes from residential districts, with the exception of small, isolated areas totaling less than one percent.”

Lamb said he feels it is important to look at potentially shrinking the DDA tax capture district out of fiscal responsibility to the residents and village government.

“I believe that it is unfair for the downtown district to capture residents’ taxes. The residents’ taxes are for use for the residents, for their community: for their streets, for their sewer and water,” Lamb said on Monday in an interview with The Review. “The DDA capture is for use for the businesses to promote economic development.”

The DDA boundaries and tax capture district were created in 1985 by the village council at that time. Since that time, the DDA captures a percentage of the increases of taxes on properties within the DDA district.

“I believe that there was an accident in 1985 when they created the district and included all of the residential properties. Actually, I believe it’s illegal, but I’m not an attorney or a judge,” said Lamb, who is a Civil Engineer and licensed real estate broker.

Right now, the plan is in the early stages but Lamb feels at least some of the council will support some degree of amendment to the DDA district.

“I think right now that we have a general feeling that it would be appropriate for the downtown district to exclude all of the residential parcels. My last presentation showed that all of the other DDAs (in Oakland County) do not include residential parcels. And there was open comment by council that this would be appropriate,” Lamb said.

Lamb added that he is not trying to dissolve the DDA. During the March 14 council meeting, several business owners, DDA board members and Orion Township Supervisor Chris Barnett spoke against any plan to dissolve the DDA.

“No, we’re not trying to dissolve the DDA. The DDA provides a useful function for the business community. And, so, if they would like to pay for it, if they would like to perpetuate it that’s great,” Lamb said. “The DDA does give back the police (millage) money, which it should give back 100 percent of the police money. The DDA should reimburse the village for the regular routine services.

“The interesting thing is that the DDA doesn’t just capture village taxes, it captures county taxes, township taxes and other state taxes. And so, it has a lot more money than the local services would normally charge. So, it can easily pay back any expenses to the village and still have revenue from the other tax sources,” Lamb said.

The whole point, Lamb reiterated, is that the village should collect the taxes on the residential properties so that those taxes can be used to benefit the residents through infrastructure maintenance and repairs.

Village council President Ken Van Portfliet and President Pro-Tem Jerry Narsh pointed out that the village has several infrastructure improvements it must deal with in the upcoming years: road repairs, phases 3 and 4 of the water main replacement project, fixing lift stations and plans to install two new bridges over Paint Creek – one at Children’s Park and another at Meek’s Park.

Narsh also pointed out that the village is beginning a sidewalk analysis program to identify those areas of sidewalks in the village that need repairs and then develop a schedule for repairs.

Lamb said he will present more information to the council at upcoming meetings.

“I believe we will be presenting an economic impact plan, which will detail what the economic consequences of changing the DDA district will be. These consequences will of course be increased revenues to the village government and decreased revenues to the DDA. But I believe there will be sufficient monies left for the DDA to maintain all of its functions,” Lamb said.

The village council and DDA were scheduled to have a special meeting on Tuesday after Lake Orion Review press time to hear the 2022-2023 DDA budget presentation. The DDA’s fiscal year runs from July 1, 2022 through June 30, 2023.

According to the DDA budget forecast, the DDA is anticipating collecting $890,000 in current real property taxes for the upcoming year.

Total DDA revenues, from all sources, are anticipated at $1.098 million for the 2022-2023 fiscal year, according to the proposed DDA budget.

The DDA was formed in 1985 and has been renewed by the village council four times, most recently by council vote in January 2020 to approve the DDA Tax Increment Financing capture for an additional 20 years.

With several businesses, such as the proposed marijuana facilities, and residential developments like the Ehman Center redevelopment, in the works in the village, Lamb said most of the taxes would be captured by the DDA and would not go into village coffers.

In I985, the base value of the DDA district was $10.23 million. In 2021, the taxable value of the DDA district was $44.055 million, DDA Executive Director Molly LaLone said.

Leave a Reply